A practical guide to EU ETS

With the European Union Emissions Trading System (EU ETS) now a reality for shipping, our Executive Vice President for Shipping Solutions Pekka Pakkanen looks at some of the main industry questions around the new regulation, and the practical steps that owners can take today.

What is the impact of EU ETS on shipping companies?

Although shipping has officially fallen under the scope of the EU ETS since 1 January, many shipowners and charterers are yet to figure out what this means for their businesses and operations. Often, they are missing the practical workflows not only to ensure technical compliance around buying and surrendering allowances, but also to ensure that emissions calculations are accurate. This leads to a lack of certainty on cost, which presents a potential financial risk for those companies.

In the short term, one thing is certain: EU ETS brings a new layer of administrative complexity, with additional tasks around the process of buying, managing, and surrendering allowances. Some companies had to hire a dedicated resource to handle these requirements, while others are subcontracting the task to other parties. An important question will be how they work out a strategy for the purchasing of EUAs: do they buy allowances throughout the year paying the market price at that time, or do they want to time purchases to potentially seize opportunities to buy them when market rates are low? We can also expect companies to adapt their operations and voyage planning to account for calls at transshipment ports which may impact what proportion of their emissions needs to be covered by EU Allowances (EUAs).

Beyond this, EU ETS has triggered fundamental questions around how costs and responsibility are shared between shipowners, charterers and managers. Bimco has published a set of four clauses aimed at addressing this question in charter parties, but whether the industry adopts this framework or otherwise adapts contracts will be determinant. How the industry addresses this challenge will have profound implications on shipping and beyond, impacting how costs are passed down supply chains and ultimately to customers.

What should shipowners and charterers do to comply with EU ETS?

In terms of reporting requirements, most companies already have the data that they need to ensure compliance, which they have been collecting since 2018 under the EU’s Monitoring, Reporting and Verification (MRV) system. But compliance is one thing; using this data proactively to achieve better business outcomes is where the true potential is.

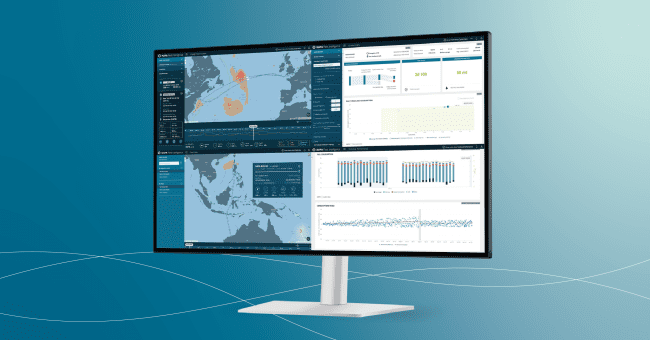

To be ahead of the game, an essential starting point is for companies to have a comprehensive and data-driven view of their operational patterns and emissions – past, present, and future. This is where data analysis and simulation tools can play a critical role, enabling owners and charterers to predict emissions for every vessel, and even model what measures will have the most impact. In practice, this gives companies three crucial advantages:

Identifying how they can optimize to reduce GHG emissions, so they have fewer allowances to buy in the first place.

Knowing precisely how many allowances will be required for each voyage and throughout the year, which enables them to beat high price volatility and buy EUAs strategically when markets are favorable.

Having a neutral assessment of emissions for each voyage which informs cost-sharing by bringing shipowners and charterers on the same page.

How much will it cost?

This is (literally) a billion-dollar question, and the answer will vary enormously depending on the ship type and segment. We won’t see the full financial impact immediately, because EU ETS will be phased in: the share of emissions that needs to be covered by EUAs will rise from 40% for the 2024 calendar year to 100% in 2026 (50% for voyages between an EU and a non-EU port).

According to analysis from Clarksons Research based on 2022 trading patterns and an EUA price of $90 per ton, the total cost of EUAs for shipping will be $3.3bn next year, and could rise to $8bn by 2026. Container ships are expected to account for the largest share of allowances, at 27%. The report shows that a VLCC sailing from Ras Tanura to Rotterdam would need $200,000 in allowances this year, which represents 4% of current freight costs. This is expected to rise to 10% in 2026 when EU ETS is fully phased in.

Those figures demonstrate the importance of making the most of existing and proven technology to reduce GHG emissions in the short term. Every % of fuel saved will help reduce the EU ETS bill for shipping, helping companies remain competitive.

What practical measures will have the most impact on a ship’s financial viability under EU ETS?

In the immediate term, the most obvious place to start is voyage optimization, which has the twin benefit of minimizing fuel consumption and emissions for every sea passage, and bringing more predictability for companies. This should be a no-brainer, as those systems can already be deployed with little to no CAPEX and save an average of 10% fuel consumption on some routes. Crucially, voyage optimization offers benefits even on shorter journeys, such as intra-European routes.

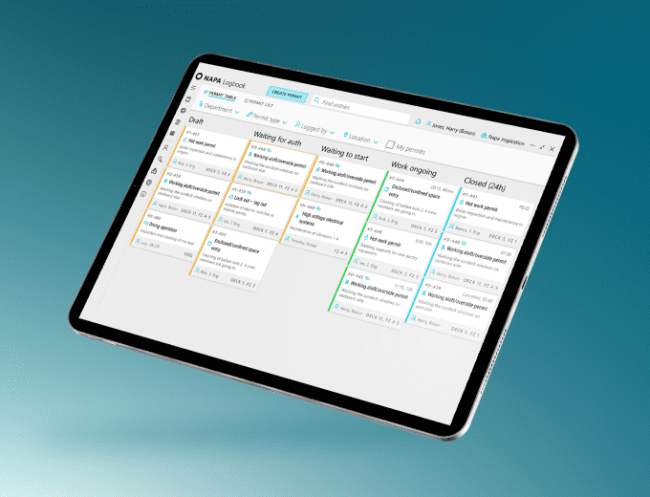

NAPA Voyage OptimizationMore broadly, it is essential that companies have a strategy in place for reducing emissions in line with tightening requirements of EU ETS, but also FuelEU which is around the corner. This relies on being able to track and manage performance at a vessel and fleet level, which will require comprehensive data, and the right tools to enable everyone from captains to board rooms to make sense of it. In the longer term, this comprehensive understanding of one’s operations will also be an essential foundation for the transition to the zero-carbon fuels that will be required to bring shipping to net-zero.

How to ensure your shipping operations are not just compliant, but also optimized for the future?

NAPA’s advanced data analysis and simulation tools can transform your approach to EU ETS compliance. Learn how to proactively manage your emissions, strategically purchase EU Allowances, and significantly reduce your GHG emissions through operational optimizations.

Book a demo